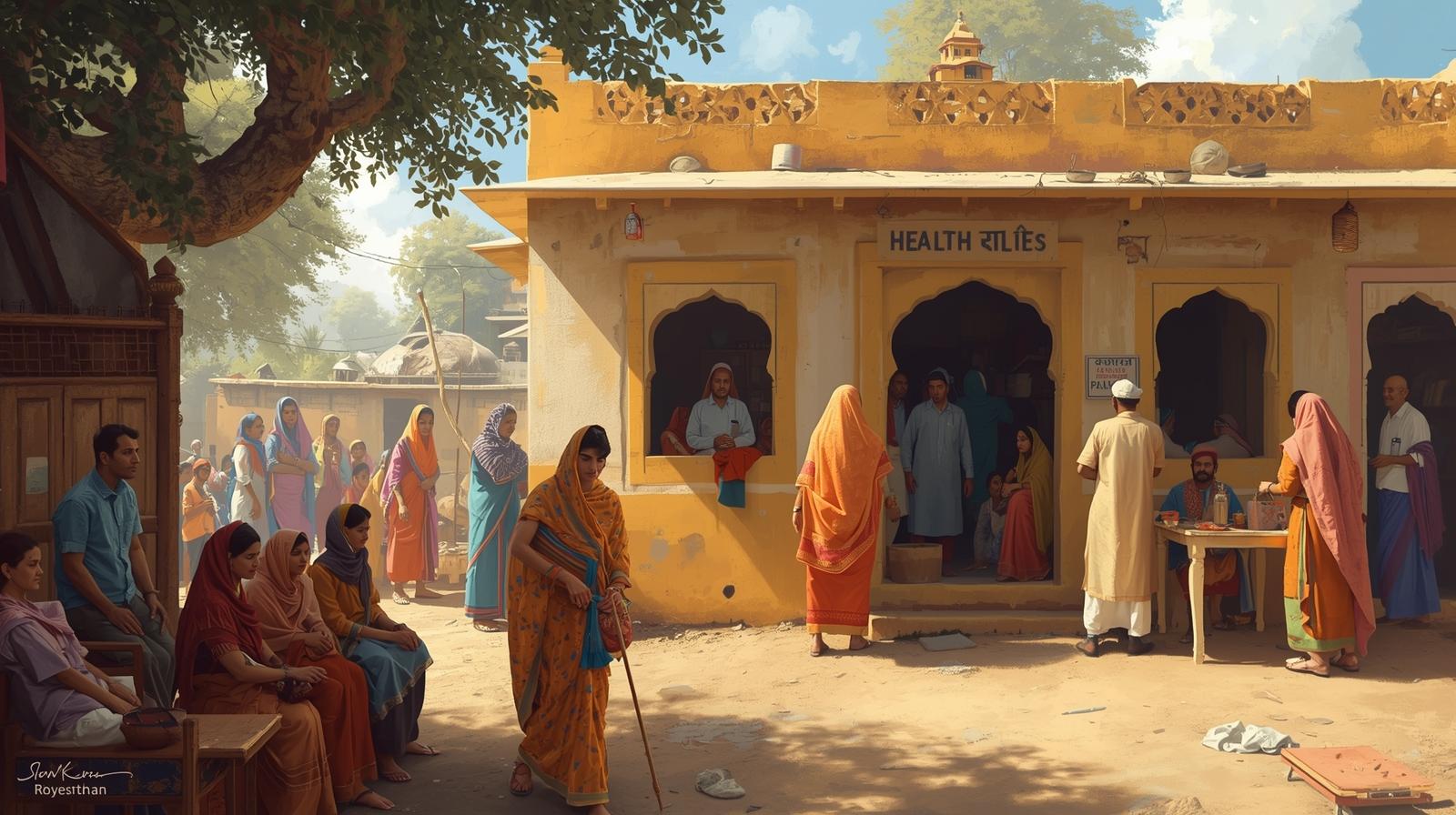

Chiranjeevi Health Insurance Govt Scheme

Discover how the Chiranjeevi scheme provides health cover through a state-sponsored insurance plan

6 Min

Mahak Chauhan

November 21, 2025

Anyone who has faced sudden illness in the family knows the amount of stress involved, not only emotional but financial also. The hospital bills start piling up, and before a person knows it, the concerns are shifted more towards money than recovery. It's precisely such situations that the Chiranjeevi Health Insurance Govt Scheme tries to avoid.

It has been specially designed for the people of Rajasthan and comprises one of the most liberal state-funded health schemes of the country. For those who heard about it for the first time or wanted an explanation in simpler terms, this guide is here to make things simple, friendly, and easy to understand.

Now, let us dive into what the Chiranjeevi Health Insurance Scheme is, who benefits from it, how to apply, what is covered, and what should be kept in mind.

What is the Chiranjeevi Health Insurance Govt Scheme?

The Chiranjeevi Health Insurance Govt Scheme, popularly known as the Mukhyamantri Chiranjeevi Swasthya Bima Yojana-now named under some updates as Mukhyamantri Ayushman Arogya-is a state-funded medical insurance program introduced by the Government of Rajasthan.

Its purpose is simple:

- Reduce the financial burden of medical treatment.

- Ensuring cashless healthcare at empanelled hospitals

- Protecting economically weaker families against health emergencies.

In this scheme, the beneficiary families are eligible for availing cashless treatment both in government and private empanelled hospitals. Not just this, the scheme provides a very high coverage amount, which makes it one of the most comprehensive state health schemes in the country.

Why was the Chiranjeevi Health Insurance Scheme introduced?

Medical care, even basic treatment, is not inexpensive. For poor and vulnerable families, these costs could be disastrous. The government launched this scheme with three clear goals:

To provide Universal Health Coverage

The idea was to ensure that every household, especially the poor and vulnerable, had access to quality healthcare without worrying about expenses.

To protect families from medical debt

A severe illness can plunge families into debt. This scheme acts like a shield against huge hospital bills.

To offer affordable or free insurance

Many eligible families get insured free of cost, while the rest of them can join by paying a very affordable annual premium.

Key Features & Benefits of the Chiranjeevi Health Insurance Govt Scheme

Let's look at what makes the chiranjeevi health insurance scheme unique:

1. High Coverage Amount

The scheme provides for a medical cover of up to ₹25 lakh per family, which is significantly higher than for most government schemes.

2. Cashless Treatment

Beneficiaries can get treatment free of cost at empanelled hospitals. The amount is directly settled between the government and the hospital.

3. Extensive List of Covered Procedures

The scheme covers over 1,500+ medical procedures including:

- Major surgeries

- Organ transplantation

- Treatment of cancer

- COVID-19 treatment

- Accidental injuries

- Kidney and liver procedures

- Cardiac surgeries

You also get cover for pre- and post-hospitalisation expenses.

4. No Age or Family Size Limits

From a small nuclear family to a large joint family, everyone gets covered. Even newborns are included.

5. Affordable Premium for Non-Eligible Families

If you are not in the free category, you can enrol in the scheme by paying an annual premium of ₹850.

6. Accident Cover

Eligible families receive an additional ₹5 lakh accident cover that helps them in case of a serious injury or emergency.

7. Empanelled Hospitals Across the State

This consists of both public and private hospitals, allowing for access to a wide network of care providers.

8. Support by Aarogyamithras

These are on-ground assistants who help beneficiaries with the following:

- Scheme enrolment

- Filling forms

- Admission to the hospital

- Claim processes

- Discharge documents

This helps minimize confusion and results in a smoother experience for patients.

Who is eligible for the Scheme?

You may be eligible if your family fits into any of the following categories:

- Households included under SECC 2011

- Families covered under the National Food Security Act (NFSA)

- Small and marginal farmers

- Contract workers in any department/board of the Government of Rajasthan

- Economically weak families that were identified

- Families enrolled under Jan-Aadhaar scheme

Even if you are not qualified under the free category, you can still join provided you pay the premium.

The best part?

There is no restriction on age or the number of family members, so the entire family stays protected.

How to Apply for the Chiranjeevi Health Insurance Govt Scheme

Here's a simple step-by-step guide to applying.

Step 1: Go to the Official Rajasthan SSO Portal

Create an account or log in with your Jan-Aadhaar or other ID details.

Step 2: Select the Relevant Scheme Category

Choose whether you are eligible for free coverage or the ₹850 premium option, depending on your eligibility.

Step 3: Submission of Required Documents

You will need:

- Jan-Aadhaar Card

- Address proof

- Identity proof

- Any documents proving eligibility (if applicable)

Step 4: Complete Enrolment

Once verified, you will be enrolled under the scheme.

Step 5: Receive the Scheme Card

This card is important in that you get cashless treatment.

Step 6: Avail the Card at Empanelled Hospitals

Show the card during hospitalisation. The hospital will initiate the pre-authorisation and process your treatment under the scheme.

Step 7: Follow Post-Discharge Procedures

Keep the discharge summaries, medicines, and reports safely for future needs.

What's Covered Under the Scheme?

Here's a quick look at the key coverage features:

- Inpatient hospitalisation

- Intensive Care Unit services

- Major and minor surgeries

- Organ transplantation surgeries

- Emergency and accident-related treatments

- COVID-19 care

- Cancer care

- Diagnostics and tests

- Prescribed medications

- Pre-hospitalisation costs: up to 5 days

- Post-hospitalization expenses (up to 15 days)

- Treatment of chronic diseases according to the procedure list

Basically, the scheme offers extensive coverage that's rare for a government-backed plan.

Pros and Cons of the Chiranjeevi Health Insurance Govt Scheme

Pros:

- One of the highest coverage amounts in India

- Cashless treatment reduces financial stress.

- Private hospitals with wider choices

- Affordable premium for families who don't qualify for free benefits

- No age or family size limit

- Dedicated assistance from Aarogyamithras

- Covers many high-cost procedures like organ transplant

Cons:

- Cashless treatment is available only at empanelled hospitals.

- Not all hospitals in small towns may be included.

- Scheme benefits are subject to change at any time, according to government decisions.

- Awareness remains very low, with many eligible families still unenrolled.

Recent Updates and Changes

Recent updates indicate that:

- The scheme is being rebranded under newer government health programmes.

- The scheme’s coverage limit has been revised over time, and the current limit is ₹25 lakh per family.

- More treatments and packages were added, including transplant surgeries.

- There have been discussions about aligning certain features of the scheme with national programmes such as Ayushman Bharat.

It's always a good idea to be updated with official announcements on any changes.

Tips to Make the Most of the Scheme

- Always carry your Jan-Aadhaar and scheme card with you.

- Check if the hospital you visit is empanelled.

- If you are confused, speak to the Aarogyamithra.

- Keep all medical reports safely.

- Check your enrollment status each year.

- Keep track of government updates on a regular basis.

Conclusion

The Chiranjeevi Health Insurance Govt Scheme is more than a policy; it's a lifeline for thousands of families in Rajasthan, thanks to its generous coverage, simple enrolment, and long list of benefits. It has helped countless households avoid financial distress during medical emergencies. If one resides in Rajasthan or knows of someone doing so, this is one scheme worth understanding and availing. Health emergencies come without inviting themselves, and insurance at the correct time could make all the difference.

Talk to an OneAssure Insurance Expert

Get the best policy with proper guidance

Get on a Call Now.