When Life Happens, we’re the Team That Shows Up

Because when you’re in a hospital bed or filling out forms at 2 am, you don’t need a helpline - you need humans who’ll stay till it’s sorted.

Testimonials

Relief, As Our Customers Describe it

We stand by you when it matters most.

swipe

When You Need Us Most, We’re Already There

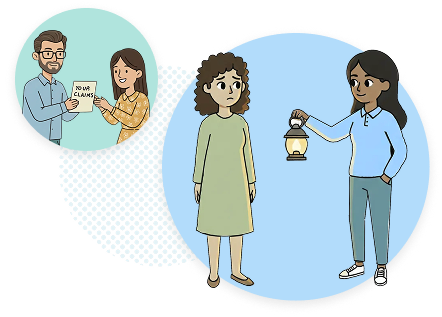

You Tell Us What Happened

We start right away - calmly, clearly, and with no judgment.

We Handle the Messy Bits

Forms, emails, follow-ups, documents, all managed for you.

We Talk to the Insurer

You focus on getting better. We’ll do the back-and-forth.

We Stay Till It’s Done

Every claim ends with closure, not confusion.

The Kind of Care You Need

We translate insurance into human language

We translate insurance into human language

We stick around until AND after the payout - because that’s when support really matters

We stick around until AND after the payout - because that’s when support really matters

We make fairness feel possible - no hidden terms, no silence, no runaround

We make fairness feel possible - no hidden terms, no silence, no runaround

Need to make a claim or understand your cover?

Reach out - you’ll get a real person who listens, explains, and acts fast.