Pre and Post Hospitalisation Expenses in Health Insurance

7

Mahak Chauhan

November 18, 2025

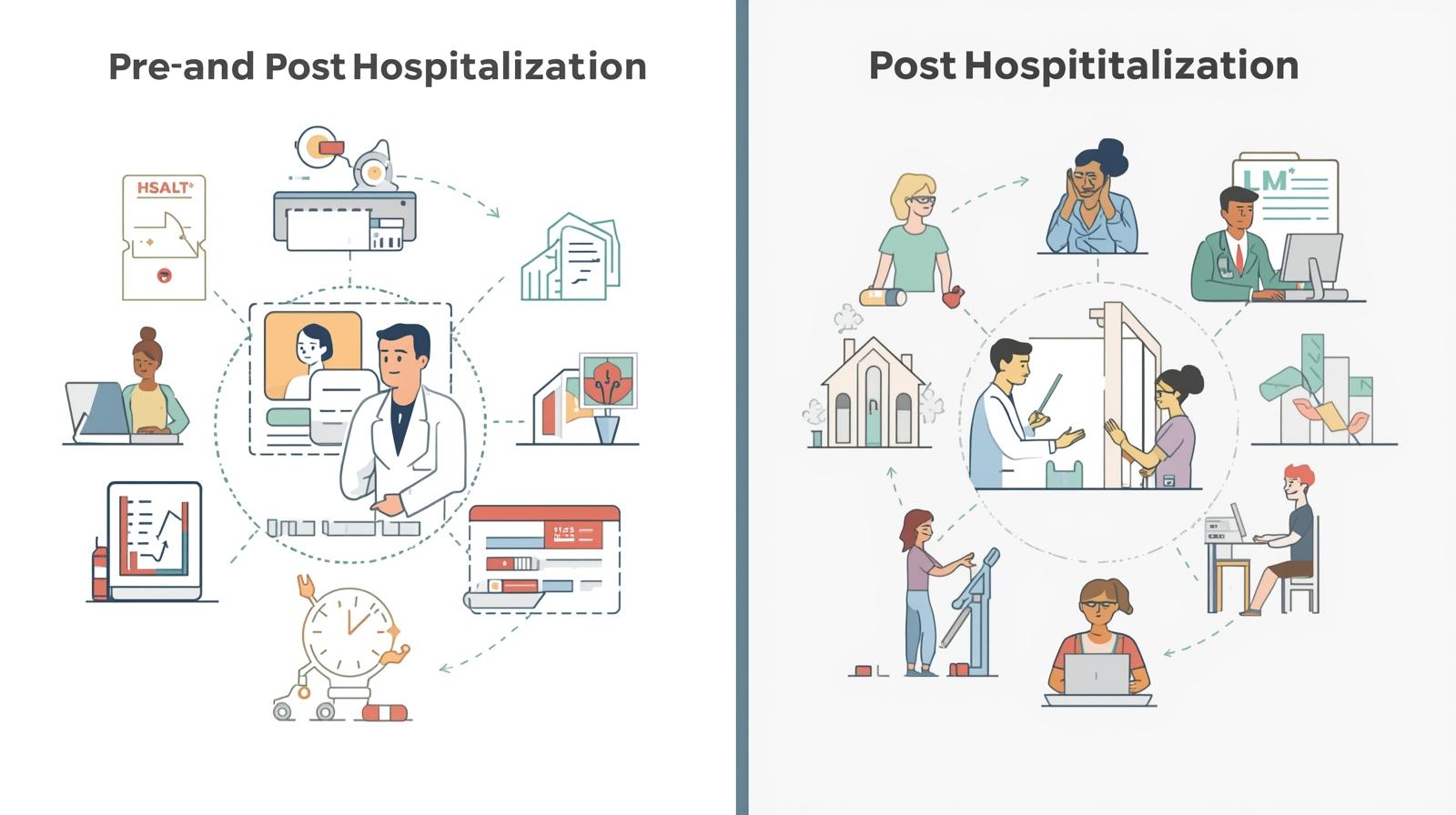

If you have ever been hospitalized, you already know that the medical bill is only one part of the expenses. There are consultations before admission, tests, medicines, follow-up visits and sometimes weeks of treatment after discharge. All of these can add up quickly.

This is where Pre Hospitalisation Expenses and Post Hospitalisation Expenses in health insurance become incredibly helpful.

But many people still ask questions like -

- What counts as pre hospitalisation and post hospitalisation ?

- How many days are covered ?

- What proof do I need for claims ?

- Do all policies cover these expenses ?

- Are there any conditions or exclusions ?

If you have these doubts, you are not alone. This blog breaks it all down in the simplest, most conversational way - so you can understand your health insurance benefits without any stress.

What Are Pre Hospitalisation Expenses ?

Think of everything that happens before the doctor finally decides, “Yes, you need to be admitted” .

These costs often fall under Pre Hospitalisation Expenses.

In simple terms, these are medical costs you incur before you are admitted to the hospital, but directly linked to the treatment for which you were hospitalised.

Common examples

- Doctor’s consultations

- Diagnostic tests (blood and urine test, MRI, CT scan, X-ray, etc.)

- Prescribed Medicine before admission

- Medical investigations

- Routine check-ups related to the main illness

- Specialist opinion fees

Most health insurance plans cover pre-hospitalisation for 30 days, 45 days, or 60 days, depending on the policy.

Why is this important?

For diagnosis, doctors do not ask in a single consultation. People often undergo a series of tests and doctor visits before the actual treatment begins. Without insurance coverage, these costs can quickly escalate to thousands of pounds.

What Are Post Hospitalisation Expenses?

Once you are discharged, the treatment rarely ends on the same day. There are follow-ups, medicines, physiotherapy sessions and even more tests. These fall under Post Hospitalisation Expenses.

In simple words, these are medical costs you incur after you leave the hospital but are still part of your recovery from the same illness or surgery.

Common examples

- Follow-up doctor visit charges

- Medicines after discharge

- Diagnostic tests

- Dressing changes or wound care

- Physiotherapy

- Post-operative consultations

- Speech therapy or rehabilitation (if related to the same condition)

Most health insurers cover post-hospitalisation for 60 days, 90 days, or even 180 days, depending on the plan.

Why is post-hospitalisation cover important?

Because the recovery phase is often the most expensive part. Follow-up tests, medicines and therapies add up rapidly. Having insurance that covers these helps you focus on getting better instead of worrying about bills.

Why Do Health Insurers Cover Pre and Post-Hospitalisation?

Many people wonder, “If insurance is for hospital bills, why cover expenses outside the hospital”?

It’s simple. Treatment is not limited to hospital admission. A patient’s journey includes -

- Symptoms

- Diagnosis

- Admission

- Treatment

- Recovery

Pre-Hospitalisation Expenses ensure the insurer pays for the work done to diagnose your illness. Post-Hospitalisation Expenses ensure the insurer also supports you through recovery.

This makes the health cover more useful, complete and practical.

Do All Health Insurance Policies Cover These Expenses?

Most comprehensive health insurance plans cover both Pre Hospitalisation Expenses and Post Hospitalisation Expenses, but the number of covered days varies.

What may differ from one insurer to another -

- Number of days covered

- List of admissible expenses

- Claim filing requirements

- Whether co-pay applies

- Whether particular tests are excluded

- like Ayurveda any alternative treatments are included

Read the wording of policy documents carefully or ask your insurer for clarity, if you have confusion.

How Many Days Are Covered?

This is the most frequent question asked by people, so here is a simple breakdown.

Pre Hospitalisation Expenses

- Typically 30 days

- Sometimes 45–60 days

- High-end plans may offer 90 days

Post Hospitalisation Expenses

- Usually 60 days

- Many insurers offer 90 days

- Some premium plans offer 180 days

If you expect long-term treatment, choosing a plan with longer post-hospitalisation cover is helpful.

What Is Needed to Claim Pre and Post Hospitalisation Expenses ?

You usually need the following -

- Doctor’s consultation prescriptions

- Test reports

- Pharmacy bills

- Original invoices

- Hospital admission proof

- Discharge summary

- Follow-up prescriptions

- Payment receipts

The golden rule is - every expense must be directly linked to the same illness or treatment for which you were hospitalised.

If you buy medicines for another ailment, for example, those do not get covered.

When Can Claims Be Rejected?

This is the part most customers worry about. Claims may be rejected if -

- The expense is not related to the main treatment

- Bills are missing

- Tests were done too early (outside the eligible days)

- You visited a non-qualified practitioner

- Medicines were purchased without a valid prescription

- The insurer finds the treatment unrelated

So keep all receipts organised and ensure the doctor has clearly mentioned the diagnosis and reason for tests or medicines.

Do Cashless Claims Cover Pre and Post Hospitalisation ?

Here’s the good news and the limitation -

Cashless YES, but only for hospitalisation.

The cashless facility usually covers only the in-hospital expenses. For pre and post-hospitalisation, you typically need to -

- Pay out of pocket first

- Collect all bills

- Submit them for reimbursement after discharge

Some insurers are now offering cashless OPD or cashless consultation networks, but this is still limited.

How Do Pre and Post Hospitalisation Benefits Help You Save Money?

Let’s look at a quick example.

Imagine you had severe chest pain. Before the doctor confirms you need a procedure, you go through -

- ECG

- Blood tests

- Chest X-ray

- Cardiologist visits

- Medicines

This may cost ₹400–₹600 even before hospitalisation.

After your treatment, you may need -

- Follow-up visits

- Blood tests

- Medicines

- Rehabilitation

This may cost another ₹300–₹500.

That’s ₹700–₹1,000 saved - just because your policy covered both stages of treatment.

Do These Benefits Apply to All Illnesses?

Usually, yes, for all illnesses or injuries that require hospitalisation.

However, insurers may exclude -

- Cosmetic surgery

- Weight-loss procedures

- Experimental treatments

- Non-allopathic therapies (if not included in the policy)

Always check your policy terms.

What About Day-Care Treatments ?

Good question!

In most cases, if your insurer covers day-care treatments (like cataract surgery or chemotherapy), then Pre Hospitalisation Expenses and Post Hospitalisation Expenses are usually covered for these too - provided they fall within the allowed number of days.

Tips to Get the Best Out of Your Pre and Post Hospitalisation Cover

Here are some easy ways to make the most of these benefits -

1. Keep prescriptions safe

Every test and medicine must have a valid doctor’s note.

2. Ask for detailed bills

Pharmacy bills should list the medicine names, quantities and prices.

3. Submit documents within deadlines

Insurers usually have a 7–15 day window after discharge to submit claims.

4. Choose plans with longer coverage days

Especially if you have chronic conditions or may require long recovery periods.

5. Understand your exclusions

Know what your policy doesn’t cover.

6. Use the insurer’s app

Most insurers let you upload bills and track claims online.

In short

Understanding Pre Hospitalisation Expenses and Post Hospitalisation Expenses in health insurance is essential because these costs form a major part of your treatment journey.

A good health insurance plan does more than pay hospital bills - it supports you from the first consultation to the last follow-up.

When you know what’s covered, what isn’t and how to claim, you can focus fully on recovery, comfort and peace of mind.

Explore Related Health Insurance Articles

Post Office Health Insurance Scheme I Star Health Insurance Reviews I ICICI Elevate Vs HDFC ERGO Optima I How To Surrender HDFC Life Policy I Top 10 Health Insurance Companies by Claim Ratio I Aditya Birla Health Insurance Reviews I Maternity Insurance Plans 3 Months Waiting I ICICI Elevate Vs Care Supreme I GIPSA Full Form I ICICI Lombard Health Insurance Reviews I Niva Bupa Vs HDFC ERGO I Best Dental Insurance In India

Talk to an OneAssure Insurance Expert

Get the best policy with proper guidance

Get on a Call Now.